During 2025, many law firms across England and Wales noticed something that felt difficult to explain.

Some firms saw a gradual decline in website traffic even though their rankings had not changed. Others noticed that enquiry volumes had become more volatile, or that leads no longer followed the familiar seasonal patterns they had relied on for years. In some cases, firms continued to appear prominently in search results, yet those impressions no longer translated into meaningful visits.

What made this especially confusing is that nothing obvious appeared to be “wrong”. There was no Google penalty, no site outage, no sudden loss of keywords. Yet something in the system had changed.

The data in this report comes from 18 independent law firms operating across England and Wales, covering a mix of high-street, regional and multi-office practices. While no single dataset can represent every firm in the market, this cross-section provides a rare view of what is happening across the sector, rather than inside a single website or agency portfolio.

It is also important to be clear that this analysis was conducted retrospectively. The data itself was collected naturally throughout 2025 as part of routine website and search reporting. The deeper analysis only took place once we began to see similar patterns emerging across multiple firms and across other professional-services industries.

In other words, we did not go looking for evidence of AI-driven disruption. We began investigating because the disruption was already being felt.

What actually changed in search during 2025

To understand the data, it helps to first understand how search itself has evolved.

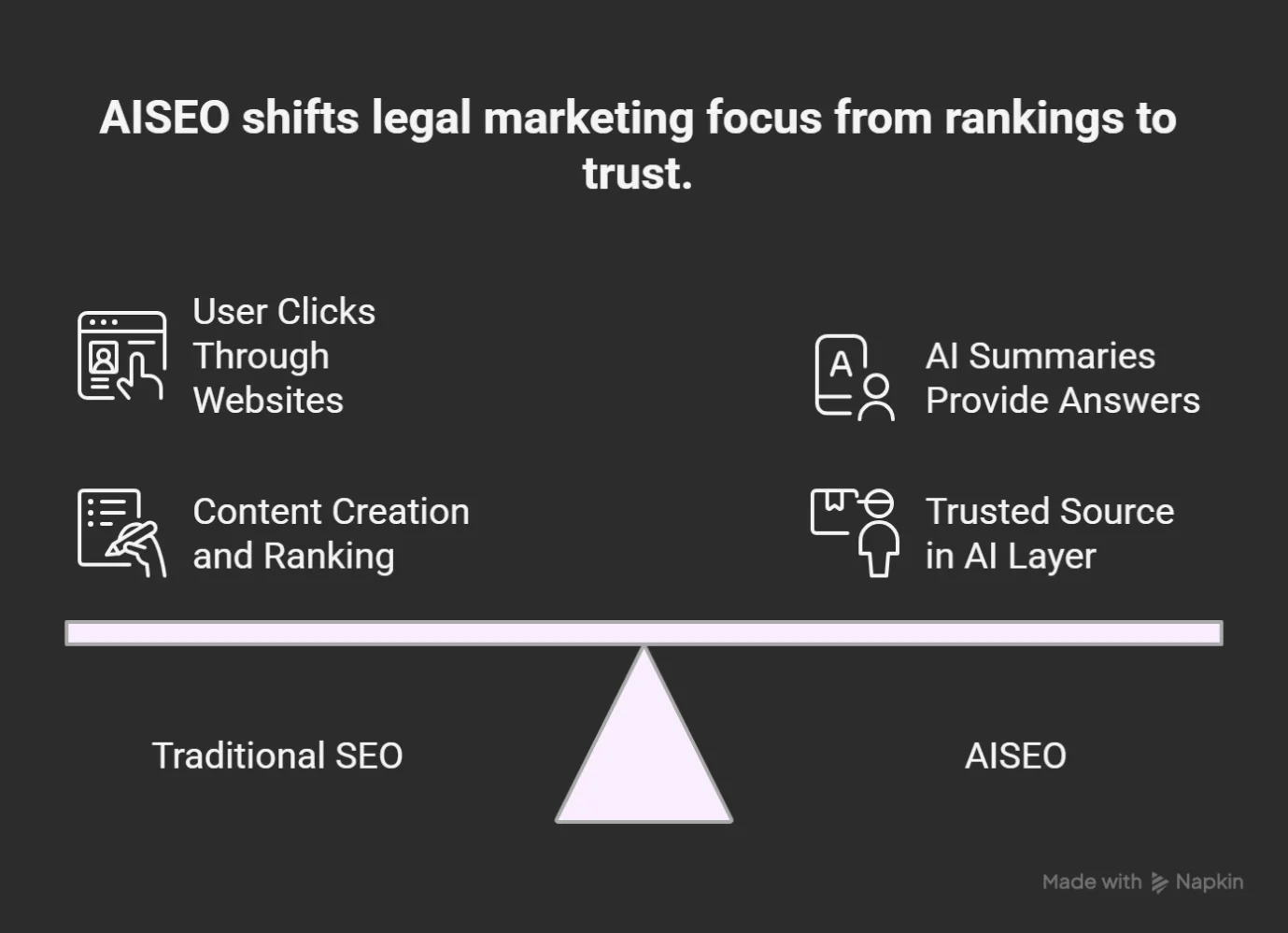

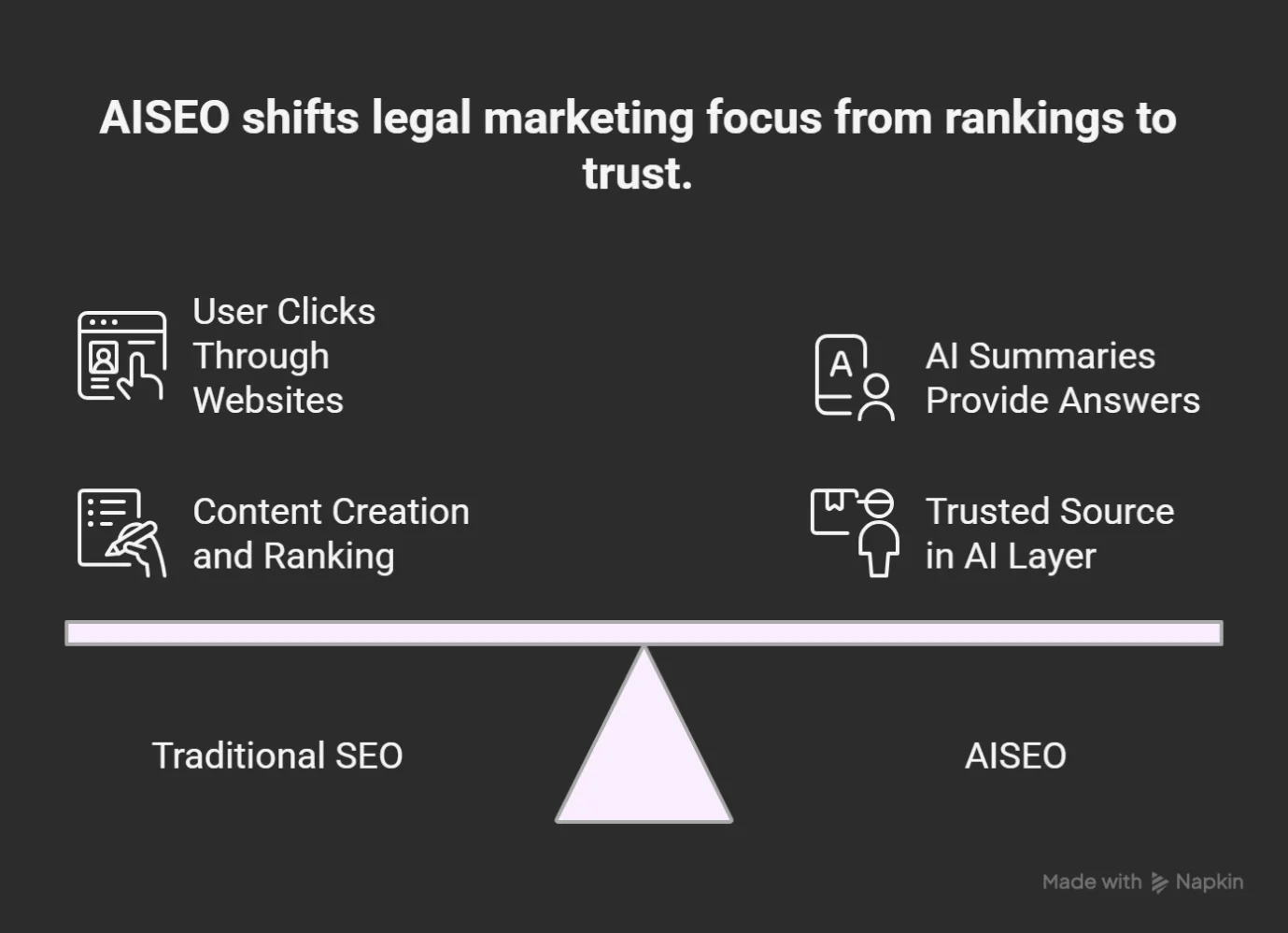

For most of the last twenty years, search engines acted as gateways. A user typed in a question or a legal problem, received a list of links, and then visited websites to find the answer. Law firms built their marketing strategies around this behaviour: create content, rank for keywords, attract visitors, convert those visitors into enquiries.

In 2025, that model began to break.

Google, Bing and other platforms now increasingly show AI-generated summaries directly on the results page. These summaries explain legal processes, outline costs, compare options and often suggest next steps. In many cases, the user can now obtain enough information to make a decision without ever clicking through to a law firm’s website.

This is what sits behind terms such as AISEO or Generative Engine Optimisation (GEO). It does not replace SEO, but it changes its purpose. Firms are no longer competing only for rankings; they are competing to be trusted sources inside the AI layer that now mediates how information is delivered.

How we analysed the legal sector

For this report, we reviewed anonymised data from 18 law firms, labelled Firm A through to Firm R. These firms vary by:

- number of offices

- urban vs rural location

- whether they run PPC

- whether they have profile and local presence management

For each firm, we analysed:

- monthly search impressions (how often the firm appeared in search)

- monthly website visitors (how many people reached the firm’s site)

The data was reviewed retrospectively once it became clear that firms across multiple sectors were experiencing unusual changes in search behaviour during the second half of 2025. We compared performance between January–August 2025 and September–December 2025, which is when generative search features became far more visible in the UK.

It is important to be clear what this dataset represents. These 18 firms are not identical, and they do not cover every niche or size of practice. However, because they span urban, rural and mixed markets, and because they operate independently of one another, the trends observed here are highly indicative of the direction of travel for legal search across England and Wales.

When multiple firms, in different locations and with different strategies, experience the same inflection point at the same time, it is a strong signal that the cause lies in the search ecosystem itself, rather than in individual marketing decisions.

The September 2025 inflection point

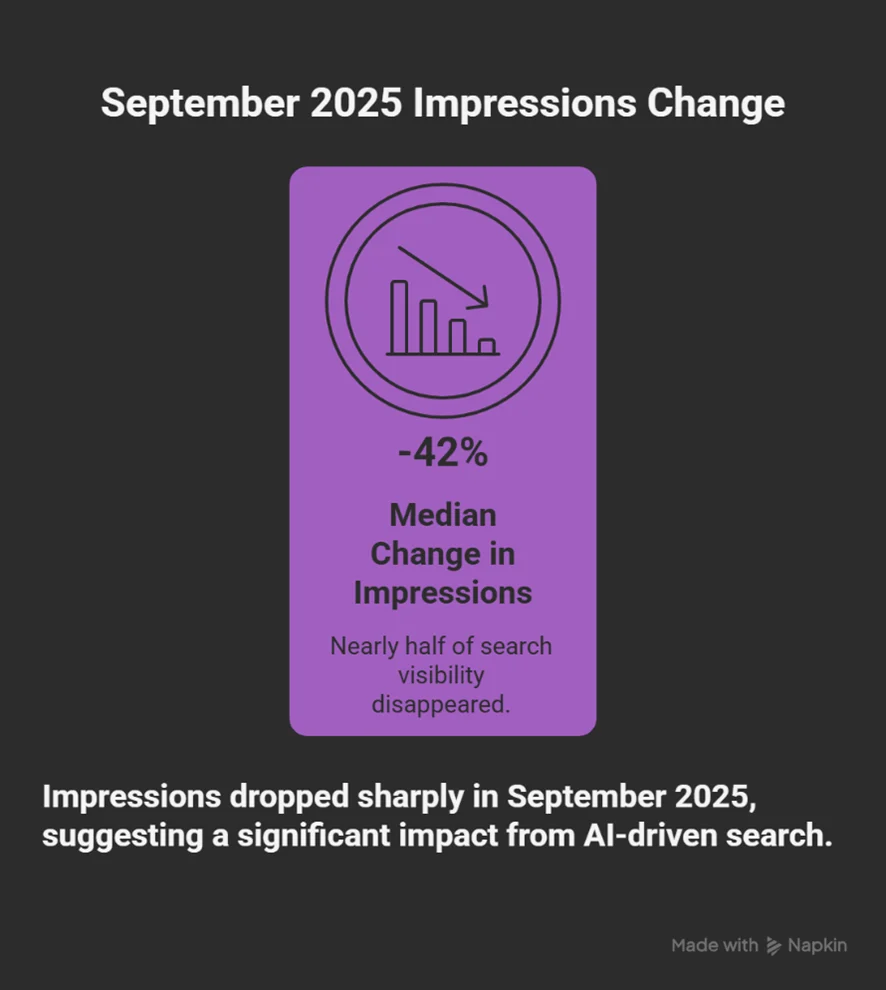

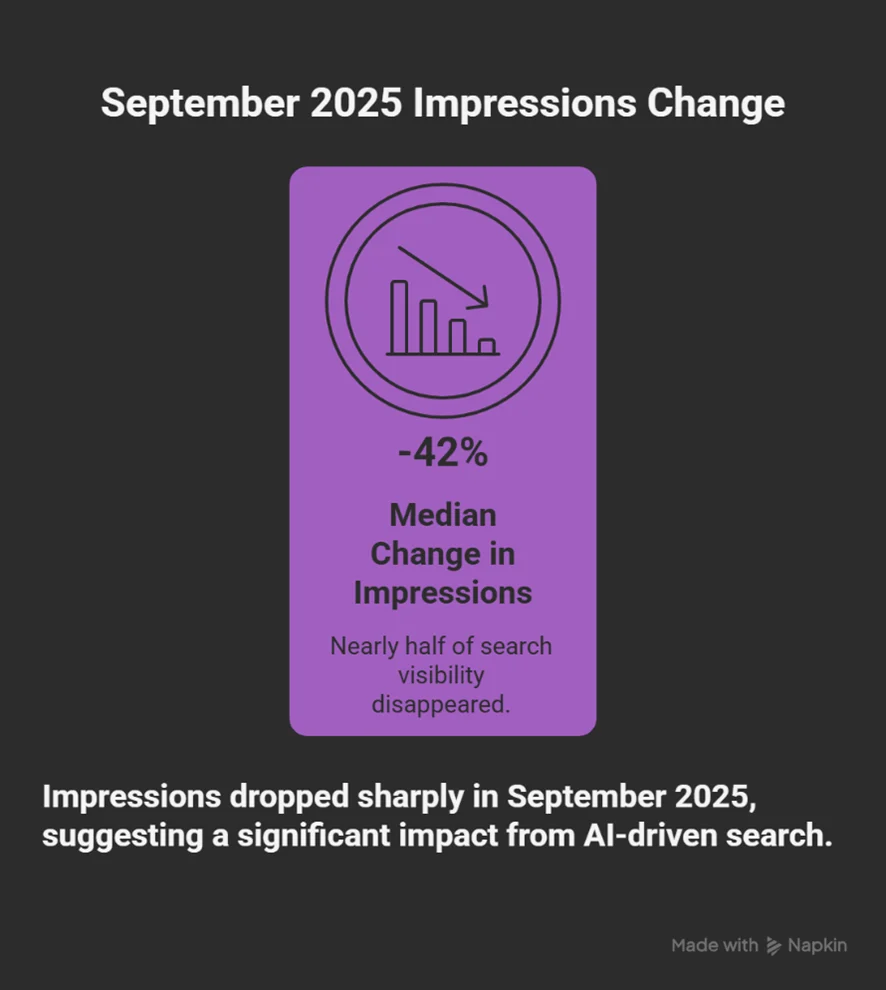

Across the dataset, one moment stands out very clearly.

September 2025.

This is where impressions dropped sharply across a large proportion of firms.

The median change in impressions after September was –42%.

In practical terms, nearly half of all search visibility disappeared across this group in the final third of the year.

The fact that this inflection appears across so many unrelated firms at roughly the same point in time strongly suggests that this was not a coincidence, a seasonal fluctuation, or the result of isolated website changes. It aligns closely with the broader rollout of AI-driven search experiences in the UK and is consistent with what is now being observed across other professional-services sectors.

Traffic fell, but not in the same way

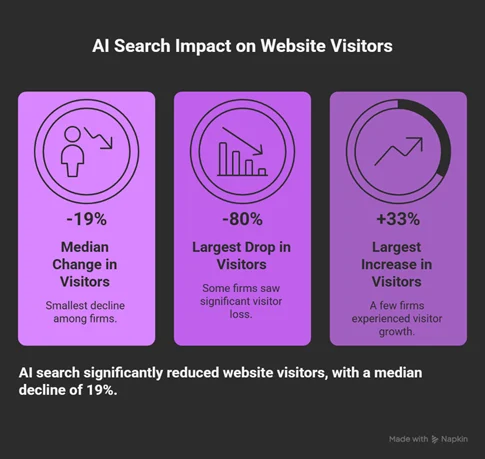

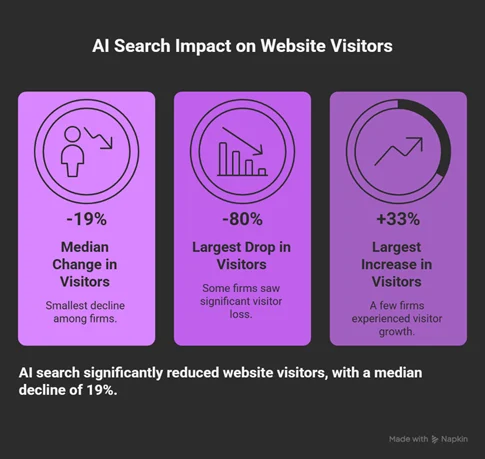

While impressions fell sharply, website visitors declined by a smaller but still significant amount.

The median change in visitors was –19%.

Some firms saw drops of nearly –80%, while a small number saw increases of up to +33%.

This gap between impressions and visitors is one of the clearest signals of AI-driven search in action. Firms were still appearing in search, but users were increasingly able to get what they needed from the results page itself. The decision-making process was happening before the click.

Urban firms were hit harder than rural firms

When we grouped firms by location, a clear pattern emerged.

Urban firms experienced larger declines in visitors and more volatility than rural firms.

City markets have:

- more competing firms

- more similar service pages

- more comparison-driven searches

These are exactly the types of queries AI summaries are best at handling. When the AI provides a confident answer, fewer users feel the need to visit multiple law firm websites.

Rural firms, while still affected, operate in less saturated markets where intent is often more direct and local, which appears to have reduced the impact slightly.

What made some firms more resilient

Two factors stood out clearly.

PPC

Firms running PPC were significantly more stable. Paid search captures high-intent queries where a solicitor is still needed — consultations, instructions and local services — even when informational searches are absorbed by AI.

Profile and local presence management

Firms with strong Google Business Profiles, reviews and consistent listings also performed better. As informational search declines, local intent becomes more valuable. For many clients, the firm they choose is now selected directly from Maps or the local pack, not from a website.

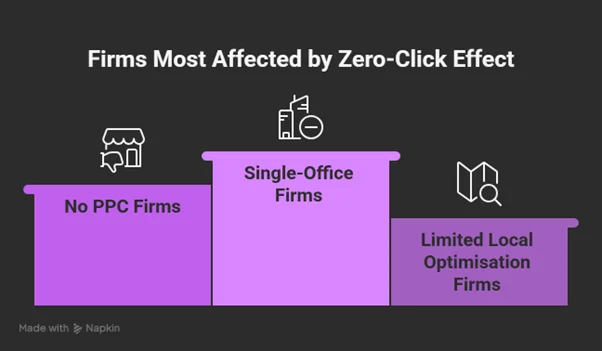

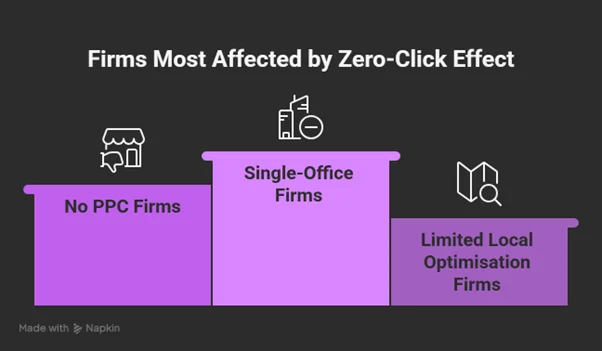

Who was hit hardest

The most affected firms typically shared these traits:

- single-office

- no PPC

- limited local optimisation

- heavy reliance on organic website traffic

These firms were most exposed to the zero-click effect, where visibility still exists but no longer produces visits.

What this means for 2026

The lesson from 2025 is not that SEO has failed.

It is that search itself has changed.

Success is now driven by:

- being referenced by AI

- being trusted locally

- being visible when someone is ready to instruct

This is the foundation of AISEO and GEO.

What firms can do themselves

Every firm can take meaningful steps:

- Make service pages answer real client questions clearly

- Treat Google Business Profile as a primary marketing asset

- Publish content based on real experience and local insight

- Track enquiries, not just rankings or traffic

Why alternative lead sources now matter

Even well-optimised firms will see organic traffic decline, because fewer people are clicking.

That is why firms now need multiple sources of demand:

- PPC

- local visibility

- partnerships

- referrals

- re-engagement of existing clients

Search is no longer a single channel. It is an ecosystem.

Final thought

What this dataset ultimately shows is not simply that search has become more difficult, or that AI has reduced website traffic. It shows that the entire mechanism by which clients discover, evaluate and choose law firms is being rewritten.

For more than two decades, law firm marketing has been built around a predictable funnel: visibility in Google leads to visits, visits lead to enquiries, and enquiries lead to instructions. That model created an understandable relationship between marketing effort and business growth. You could invest in content, SEO and rankings, and reasonably expect to see a corresponding increase in website traffic and new matters.

The AI-driven shift in search has quietly broken that relationship.

In 2025 we saw that firms could maintain visibility while losing traffic, could hold rankings while enquiries declined, and could be “present” in search without ever being part of the client’s decision-making journey. The data from these 18 firms makes that disconnect visible for the first time at a sector level.

This is not a temporary technology cycle. It is a permanent behavioural change. Clients are increasingly using search engines not as directories of websites, but as decision engines. They are asking questions, receiving synthesised answers, and moving directly to shortlists or local selections without ever browsing the open web.

For law firms, that means the competitive battlefield has shifted. The goal is no longer just to be found; it is to be trusted by the systems that now mediate trust. It is to be recognised as a credible authority by AI, as a safe local choice by Google, and as a visible brand by the client before they ever pick up the phone.

The firms that will succeed in 2026 and beyond will not be those chasing yesterday’s SEO metrics. They will be the firms that understand how AI, local search, paid media, reputation and brand now interact to form a single discovery ecosystem. They will be the firms that invest in multiple demand channels, that treat digital visibility as a strategic asset rather than a technical one, and that adapt their marketing models before the decline becomes obvious on the balance sheet.

The data from 2025 gives us a clear warning.

The firms that respond to it will build more resilient, more profitable and more future-proof practices.

Those that ignore it may not notice the damage straight away — but by the time it is visible, it will be far harder to reverse.

Want to protect your firm’s pipeline in 2026?

As AI-driven search continues to reduce organic website traffic, the firms that perform best will be those that secure reliable, alternative sources of new enquiries alongside their digital presence.

At QualitySolicitors, we are able to deliver pre-qualified legal enquiries directly from QS.com into selected local areas across England and Wales. These are genuine client enquiries that are:

- already looking to instruct a solicitor

- matched to your location and practice areas

- screened and qualified by our First Contact Team

If you would like to understand:

- how many enquiries are available in your area

- what types of work they relate to

- and what it would cost to secure them

you can request a short, no-obligation overview below.

Find out how many legal enquiries are available in your area → Contact Us